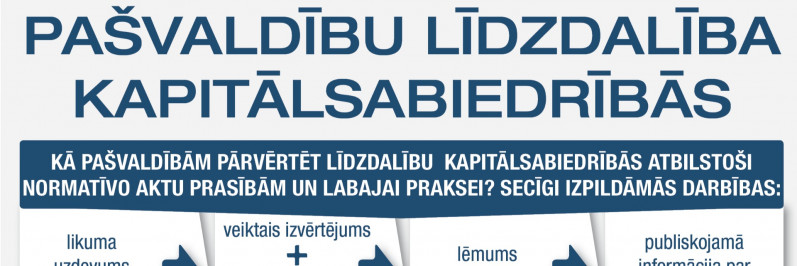

In the audit, which assessed whether and how the newly established regional governments assessed the shareholding in municipal enterprises after the Administrative and Territorial Reform (ATR), it was found that the assessment was not done in accordance with best practice and law in general. First of all, the compliance of the activities of municipal enterprises with the Law on the Structure of State Administration was evaluated incompletely. Secondly, the goals to be achieved through shareholding have not been determined, so there is no certainty in many cases as to whether local and regional governments should continue to be involved in commercial activities. Thirdly, when reassessing shareholding, local and regional governments have not analysed the financial reports and performance indicators of municipal enterprises comprehensively to make sure that they can really provide services to citizens in the long term.

BRIEFLY

- The ability of local and regional governments to reassess their shareholding in municipal enterprises comprehensively is hampered by their inefficient management significantly.

- Even after the Administrative and Territorial reform, local and regional governments continue to allow deficiencies already found during previous audits when assessing shareholding in municipal enterprises and in their management.

- Information on the activities of municipal enterprises is only partly publicly available, although it is required to be made public by law, and it is also one of the tools to facilitate the attraction of private businesses.

“If the assessment of shareholding is not provided in accordance with the law and best practice, then one fails to use the opportunity to analyse the performance of municipal enterprises and improve their performance to provide essential services to citizens,” explained Mr Edgars Korčagins, Council Member of the State Audit Office of Latvia.

The newly established regional governments in the result of the ATR shall make strategic decisions important for the population and related to resource planning and management, including shareholding in municipal enterprises. The goal of municipal enterprises is to provide residents with services arising from the functions of that local or regional government in its administrative territory. The audit sample included eight regional governments: Preiļi, Ogre, Tukums, Bauska, Cēsis, Ludza, Southern Kurzeme, and Jēkabpils Regional Governments.

The deadline set by the legislator (1 June 2022), by which the newly established regional governments had to reassess their shareholding in the municipal enterprises owned by them after the ATR, was challenging to assess the operation of the municipal enterprises comprehensively and to find out a way to provide a more economically justified service. In general, within the set deadline, out of the 89 municipal enterprises of the eight regional governments included in the audit sample, the requirement was met only for 25, where only one, Jēkabpils Regional Government, had reevaluated its shareholding in all the municipal enterprises owned by it. In its turn, during the audit until 23 February 2023, shareholding was reevaluated in 62 municipal enterprises out of 89 municipal enterprises, with the decisions made to continue shareholding in 56 municipal enterprises and reorganise 6 municipal enterprises. During the audit, the Preiļi Regional Government had not initiated the reassessment of its shareholding in any of the four municipal enterprises it owned.

The State Audit of Latvia elaborated 16 criteria during the audit to evaluate how eight regional governments reevaluated their shareholding in municipal enterprises owned by them equally and with uniform audit methods. The provisions of laws and regulations and best practice in municipal enterprises governance were put forward as criteria by assigning a certain number of points to each criterion. The state auditors consider that the total score of the set criteria with the maximum obtainable 100 points shows the ability of regional governments to justify shareholding in municipal enterprises and to ensure good management of those municipal enterprises to fulfil the functions of local and regional governments provided for by law in the most efficient way. Out of the maximum potential 100 points, the regional governments have obtained between 11 and 46 points, which indicates significant irregularities both in the solidity of shareholding in municipal enterprises and in the organization of the management of municipal enterprises.

In general, the audit concluded that the ability of regional governments to reassess shareholding in municipal enterprises fully is hampered by inefficient management of these municipal enterprises significantly.

Local and regional governments may establish municipal enterprises or hold shares in them to fulfil their municipal functions effectively. To prevent the risks that the neutrality of competition is not respected or it is distorted, local and regional governments must receive an opinion from the Competition Council. The Tukums, Jēkabpils and Bauska Regional Governments did not consult with the Competition Council before making a decision on shareholding in 29 municipal enterprises owned by them.

The 56 municipal enterprises of seven regional governments, in which they have continued their shareholding, provided 267 services in total. The state auditors consider that only 148 services (55%) out of 267 services relate to the provision of municipal functions. Hence, regional governments continue to engage in commercial activities unrelated to the performance of autonomous functions of regional governments by means of municipal enterprises, such as the services of specialists (plumbers, electricians), leasing of specialized equipment (tractors, excavators, etc.).

“Best practice for local and regional governments (and the state as a whole) would be to delegate all tasks that are not typical for them to the private sector and to implement only those functions that arise from their functions by means of municipal enterprises. Otherwise, the local and regional governments create a paradoxical situation themselves when they often engage in commercial activities with municipal enterprises instead of developing business in their administrative territories and attracting investments, and creating jobs that distort competition, which do not provide citizens with either the highest quality or the cheapest service,” explained E.Korčagins.

He also states, “When deciding on participation in a municipal enterprise, a local or regional government must specify a goal it intends to achieve with shareholding. Drawing parallels with business, this is an absolute norm to set a goal and evaluate potential benefits before making investment. Unfortunately, in the case of local and regional governments, neither setting goals nor evaluating performance is a goal.” In general, only 15 out of 53 strategies of municipal enterprises adopted the goals set by local and regional governments accurately. In its turn, the Ogre Regional Government has not even indicated the goals set for municipal enterprises in the decisions on continuing shareholding in two municipal enterprises.

In 2021, out of 71 municipal enterprises, 24 municipal enterprises (34%) did not have a valid medium-term strategy, which was a prerequisite for the possibility of impartial assessment of the performance efficiency of those municipal enterprises. In their turn, the financial and/or non-financial goals were set for 38 municipal enterprises’ strategies and only 13 municipal enterprises assessed their achievement.

Local and regional governments must implement effective management of municipal enterprises, including they should assess the economic activity of municipal enterprises before making important decisions, which would ensure the impartiality and efficiency of decisions. However, the auditors point out that local and regional governments have not assessed the performance of municipal enterprises, including economic benefits for a local or regional government from their investments in municipal enterprises.

In addition, none of 56 assessments carried out by 7 regional governments regarding the continuation of shareholding in municipal enterprises have drawn conclusions based on comprehensive and all-round analysis of financial indicators and identified risks in the operation of municipal enterprises. “The need for a comprehensive assessment of the municipal enterprise’s activity is also evidenced by the financial results of municipal enterprises calculated by the state auditors, that is, in more than 50% of cases, the municipal enterprises had a low profitability and liquidity indicator, which indicates potential problems in the operation of municipal enterprises, which may lead to insolvency if not eliminated,” explained E.Korčagins.

When making a decision on shareholding in a municipal enterprise, it is important for a local or regional government to assess the solidity of increase in share capital of municipal enterprise as well such as the purpose of investment and expected result, which characterizes the ability of municipal enterprise to ensure the fulfillment of the goals set for it. In the decisions made by local and regional governments on investment in municipal enterprises in the period from 1 January 2020 to 30 June 2022, the goals and achievable results can be identified only for the investment of 49,556 euros in total out of the investment totalling to 14,000,494 euros in 43 municipal enterprises. This shows that one has not assessed what economic benefits a local or regional government would have from investment by posing a risk of unjustified use of municipal financial resources and property.

When assessing the shareholding in a municipal enterprise, the assessment of institutional structure is also significant for the effective provision of functions. This is especially relevant after the Administrative and Territorial Reform of local and regional governments when the latter decide on continuing shareholding in municipal enterprises of several former local and regional governments, including municipal enterprises with the same types of activity. Situation in local and regional governments after the ATR shows that, for instance, up to six municipal enterprises of one local or regional government are involved in the provision of water management, heating supply, housing management and territory improvement and maintenance services.

During the audit, four out of eight regional governments had taken decisions on the reorganization of certain municipal enterprises, as a result of which one plans to regarding heating supply and water management services in the future, for instance:

- In the Bauska Regional Government, one municipal enterprise instead of five municipal enterprises will provide that;

- In the Southern Kurzeme Regional Government, three municipal enterprises instead of eight municipal enterprises will ensure that;

- In the Tukums Regional Government, four municipal enterprises instead of five municipal enterprises will provide that;

- In the Jēkabpils Regional Government, five and four municipal enterprises will continue to provide them, respectively, while it is planned to provide housing management services by five municipal enterprises instead of six municipal enterprises.

The auditors also draw attention to the fact that information on the operation of municipal enterprises is publicly available only partially, although the law requires it to be made public, and it is also one of the tools to facilitate the attraction of private businesses and to provide a specific service more effectively and economically. The statutory requirement for information to be made only one out of the eight regional governments, that is, Jēkabpils Regional Government, had met the statutory requirement for information to be made public in full as of 1 February 2023.

Local and regional governments continue to allow deficiencies in the assessment of shareholdings in municipal enterprises and in the management of municipal enterprises after the ATR, which were already detected during the previous audits by the State Audit Office of Latvia, for instance:

- Shareholding in municipal enterprises must be assessed by reasoning; decisions with complete and justified information such as facts, market research, data analysis, etc. to be able to gain confidence that the performance of administrative tasks is ensured in the most effective way (Does Talsi Regional Government manage municipal enterprises following the principles of the rule of law and best practice?);

- To improve the quality of service provision, it is necessary to assess the economy and effectiveness of institutional structure created for the organization of service provision (Does the wastewater collection, disposal and treatment system established in the country ensure environmental protection against the harmful effects of municipal wastewater?);

- When providing paid services, local and regional governments must assess thoroughly whether provision of services is related to the provision of municipal functions (Is the actions of the Local or Regional Government with property and financial resources by providing paid services appropriate to its functions to citizens effective and economical?);

- To safeguard effective management of municipal enterprises, local and regional governments shall: (1) determine the goals to be achieved by municipal enterprises, the performance indicators characterizing their performance; (2) to justify decisions on the distribution of profits of municipal enterprises, as well as on the increase of the share capital of municipal enterprises; (3) to ensure openness of information about the operation of municipal enterprises (Effectiveness an compliance of the management of municipal enterprises of the Saldus Regional Government with the statutory requirements).

State Audit Office recommendations #PēcRevīzijas

After the audit, 54 recommendations are provided to local and regional governments, the implementation of which will improve the transparency and effectiveness of operations in relation to shareholding in municipal, thus ensuring shareholding in accordance with the law. Recommendations must be implemented by 3 January 2025.

FACTS

- After the Administrative and Territorial Reform, 367 municipal enterprises operate in various areas in 43 local and regional governments of Latvia.

- Investments of local and regional governments in these municipal enterprises exceeded 1.5 billion euros in 2021.

- Municipal enterprises established by local and regional governments operate mainly in four areas: (1) public utilities (heat supply, water management, waste management); (2) residential housing management; (3) healthcare and social care; (4) transport services (public transport, school transport).

- As a result of the ATR, 104 local and regional governments were merged by establishing 28 new regional governments. As a result, up to six municipal enterprises provide the same type of services, for example, water management and heating supply services.

About the State Audit Office of Latvia

The State Audit Office of the Republic of Latvia is an independent, collegial supreme audit institution. The purpose of its activity is to find out whether the actions with the financial means and property of a public entity are legal, correct, useful and in line with public interests, as well as to provide recommendations for the elimination of discovered irregularities. The State Audit Office conducts audits in accordance with International Standards of Supreme Audit Institutions of the International Organization of Supreme Audit Institutions INTOSAI (ISSAI), whose recognition in Latvia is determined by the Auditor General.

100 years of AUDIT STRENGTH

On 16 August 2023, the State Audit Law will turn 100 years old. With the adoption of this Law, the State Audit Office from a formal de facto institution founded on 2 December 1918 became a de jure independent, collegial supreme audit institution of the Republic of Latvia. The State Audit Office is one of the independent state institutions enshrined in the Satversme (Constitution) of Latvia. The Constitution was signed by Roberts Ivanovs as the secretary of the Constitutional Assembly, who was then confirmed as the Auditor General. He worked as the first Auditor General for 12 years. His signature confirmed the text of our Constitution alongside that of Jānis Čakste.

Additional information

Ms Signe Znotiņa-Znota

Head of PR and Internal Communication Division

Ph. + 371 67017671 | M. + 371 26440185 | E-mail: signe.znotina-znota@lrvk.gov.lv